The California Legislature passed the Budget Act of 2016, Senate Bill 826 (SB 826) and a related budget bill, Senate Bill 828 (SB828), on June 15, 2015. The Governor signed the budget bills for the 2016-17 fiscal year (the “Budget”) on June 27, 2016. The following analysis addresses key child care and early education items in the Budget in light of recent history and alternative proposals offered during this year’s budget process.

I. Overview of Child Care and Early Education Funding in FY 2016-2017

The Budget appropriates an additional $145 Million for child care and early education programs for fiscal year 2016-2017, with a statement of legislative intent to continue to invest in child care as part of a multi-year effort. It includes increases in the reimbursement rates paid to child care providers that will take effect on January 1, 2017, midway through the fiscal year, representing an annualized increase of about $276 million. The enacted Budget brings the total child care spending to $1.8 billion in FY 2016-17.1 This represents an overall 2% increase from last year. Total spending for preschool in FY 2016-17 was $1.1 billion

The Budget builds on increases in the last two year budget cycles, though it offers significantly less than the $800 million in increased funding requested by the Legislative Women’s Caucus, as well as the $618.6 million recommended by the Assembly Budget Committee. The last two years’ increases, totaling $673 million, together with this year’s increase of $145 million, bring the total restoration of funding to $818 million ($956 million if annualized) of the nearly $1 billion that California cut from child care and early education programs between 2008 and 2013. The reinvestment demonstrates the Legislature’s steady commitment to child care and early education, and lays a foundation for serving more eligible children without impoverishing child care providers. At the same time, California has restored less than one third of the 110,000 spaces in state subsidized child care programs lost during the Great Recession. Investments over the last three years have tilted heavily toward pre-school age children (ages 3-5), whereas child care need for infants and toddlers (0-3) remains particularly acute. Notwithstanding modest increases in federal Child Care Development Fund (CCDF) dollars, the Budget largely fails to address California’s lack of compliance with new requirements for CCDF programs. Moreover, while the Budget takes advantage of increases in federal and Proposition 98 funding, state general funding for child care has decreased. Significant work lies ahead for child care and early education advocates.

A. Ninety-five Percent of Additional Funding Went to Increasing Child Care Provider Reimbursement Rates.

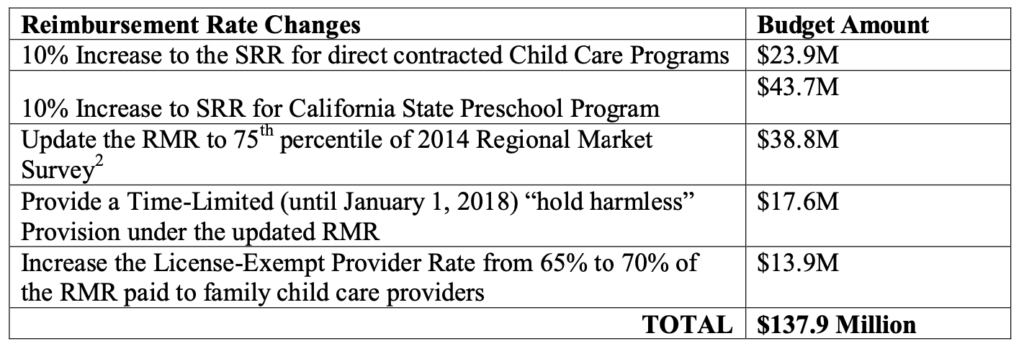

Ninety five percent of the additional child care and early education funding for FY2016- 17 is directed to increasing child care provider reimbursement rates, with the money split evenly between adjustments to the Regional Market Rate (RMR) and the Standard Reimbursement Rate (SRR). These increased child care provider reimbursement rates all take effect on January 1, 2017. The cost in FY 2016-17 is:

These reimbursement rate increases are in addition to the ongoing costs of rate increases resulting from the FY 2015-16 budget.

B. Only Full-day State Preschool Received Any Funding for Expansion; the Need to Expand Programs for 0-3 Year-Olds is Greater than Ever.

The only funding specifically allocated to increase the number of children in early learning settings is Proposition 98 funding for a total of 8,877 full-day/full-year State Preschool slots over the next three years, to be administered by the Local Educational Agencies (LEA’s). 2,959 slots will be added each year, on March 1 of 2017, 2018, and 2019. The cost in this fiscal year is $7.8 million. (See discussion in III.B, below).

C. Miscellaneous Budget Items Will Ease Administrative Burdens and Add A Pilot Training Opportunity

Trailer bill language included a provision that will ease the verification burdens for single parents, and align this requirement with other benefit programs, such as CalWORKs. A contractor must now accept a sworn statement from the parent attesting to the continued absence of the second parent. This language was based upon a recommendation from last year’s AB104 Stakeholder workgroup.

The Budget allocates $1.4 million to pay for the Child Care Apprenticeship Pilot Program in Los Angeles County, aimed at training and professional development for child care workers.

II. Analysis of the Enacted Budget

The Budget increases reimbursement rates for child care providers across the board, but by lower percentages than what was proposed by the Legislative Women’s Caucus or in the Assembly Budget Committee’s Early Education package. The increase in reimbursement rates will offer some relief to child care providers, who struggle to meet operating costs on current rates. It will also expand parents’ child care options because more child care providers will be willing to accept the higher subsidies, the options for quality care will expand, and parent co- payments will go down. However, the failure to adopt any of the provisions to expand parent eligibility and access, such as12-month eligibility, and updating and increasing the income threshold and exit ceiling, will continue to pose significant barriers to access and continuity of services. While it is significant that for parents receiving a child care subsidy, these rate increases were achieved without a loss of child care slots, the Budget did not specifically address the close to 300,000 eligible children on waiting lists for subsidized care.3

While not part of the early care and education budget, the repeal of California’s Maximum Family Grant rule, which denied cash aid to additional children born to families receiving CalWORKs grants, will provide significant relief to California’s poorest and most vulnerable families.

A. Regional Market Rate Updated to the 75th Percentile of the 2014 Survey, effective January 1, 2017.

The Budget updates the regional market reimbursement rate for providers accepting vouchers from a rate based on a combination of the 85th percentiles of the 2005 and 2009 regional market rate surveys, to the 75th percentile of the 2014 survey. The new rate goes into effect on January 1, 2017. This update includes a limited-term hold harmless for providers whose rates would be otherwise reduced, effective through June 30, 2018.

Every two years, the California Department of Education (CDE) contracts for an RMR Survey to determine the rates charged by child care providers in unsubsidized regional markets, differentiated by category of care, such as part or full time, and child care facility type. The use of the 2014 RMR survey was welcome news, as the Legislature had not utilized current survey data to set reimbursement ceilings since 2009, and the use of current market data is required under the newly reauthorized federal Child Care Development Block Grant (“CCDBG”) law.

The updated formula will provide more transparency about rates. The current RMR is set at the 85th percentile of the RMR survey conducted in 2009, minus a 10.11% deficit factor, plus a 4.5% increase. In addition, counties that received less using this formula than they received under the prior 2005 RMR Survey could instead opt to receive the amount in the 2005 rate schedule. The opacity of this rate setting methodology makes it very difficult to determine the percentage of local child care providers that parents actually have access to, and how much additional funding would be required to meet the CCDBG’s goal of statewide access to 85 percent of the child care market.

The use of the 75th percentile of the most current RMR survey is the minimum rate that is presumed under the CCDBG to ensure adequate access to subsidized child care. 42 U.S.C. §658E(c)(4).4 The Legislative Women’s Caucus and the Assembly had recommended updating the RMR to the 85th percentile of the most current survey. The use of the lower 75th percentile will result in providers in some counties experiencing a reduction in payments. The budget includes a time-limited “hold harmless” provision that allows providers, during the period from January 1, 2017 through June 30, 2018, to choose the greater of their current reimbursement rate or the new one.5

The Budget expresses legislative intent, as funds become available, to reimburse child care providers at the 85th percentile of the most recent RMR survey and update the RMR ceilings with each new survey, and to further increase the RMR ceilings through the 2018-19 fiscal year to reflect increases in the state minimum wage that providers will be paying. However, there is no guarantee that these increases will be included in future budgets. The absence of this language will cause our reimbursement rate structure to fall out of date each time a new survey is published.

B. License-Exempt Rate Will Increase to 70% of the Family Child Care Home Rate, effective January 1, 2017.

License-exempt providers receive the lowest reimbursement rate of any providers, sometimes as low as $2 per hour for part-time care. The Assembly Budget Committee recommended increasing the license- exempt reimbursement rate to 80% of the Family Child Care Home (FCCH) rate; the Governor and Senate budget proposals were silent on this issue. License- exempt providers will benefit from both of the rate increases contained in this year’s Budget – the updating of the RMR, and the increase from 65% to 70% of the RMR for license- FCCH’s. The cost for this fiscal year is $13.9 million.

C. Standard Reimbursement Rate Will Increase by 10%, With no Accompanying Rate Structure Reform.

The state pays a Standard Reimbursement Rate (SRR) per child, regardless of geographical location, to child care centers and family child care home education networks that contract directly with CDE to provide child and development services. This year’s modest 10% increase in the SRR, on top of last year’s 5% increase, will raise the SRR to $42.12 per day, plus adjustments for factors such as age, exceptional needs, and no or limited English speaking.6 The budget appropriates $68 million for this increase, to take effect on January 1, 2017.

The Legislative Women’s Caucus had proposed a new rate structure for the SRR, taking a first step toward a regionalized rate system. Under this proposal, the SRR would have been benched to the RMR in which that center operates. Notwithstanding longstanding concerns raised by child care providers, stakeholders and policymakers on the disparities created by having a single rate structure for reimbursing the cost of care across California, it was felt that there was insufficient time during the compressed budget process to work out the complex details of converting to a regionalized rate structure. Work on developing a phased plan for merging the two rate structures should continue to be a goal in the coming year.

The 10% rate increase was accompanied by a statement of legislative intent to further increase the SRR through the 2018-19 fiscal year to reflect increased provider costs as a result of state minimum wage increases. However, the only entity which received a guarantee of future increases was for CSPP. Trailer bill language amended Education Code to provide for CSPP rate increases in future years, pegged to the increases provided in the K-12 system pursuant to the Education Code § 42238.15.7

D. CalWORKs Child Care Programs

Parents have a right to receive CalWORKs child care as a supportive service while they participate in CalWORKs welfare-to-work activities and after they leave the CalWORKs grant program, so long as they remain otherwise eligible for state child care programs. The Legislature determines CalWORKs child care slots and funding based on anticipated caseload. The three stages of CalWORKs child care received an increase of $199 million in FY 2015-2016 to pay for an additional 5,600 child care slots and increased rates to child care providers. This year’s CalWORKs child care funding reflects the offsetting combination of increased provider reimbursement rates, lower than expected caseload in FY 2015-16, and a further anticipated reduction in CalWORKs child care caseloads. While reduced Stage One funding could accurately reflect the ongoing reductions in the numbers of families who are receiving CalWORKs cash aid, Stages Two and Three, which serve former participants in the CalWORKs program, have also experienced drops in the number of children served. Stage One funding for FY2016-17 is at $413 million, Stage Two funding is at $445 million, and Stage Three funding is at $287 million. This $1.1 billion pays for child care for approximately 129,000 children of current and former CalWORKs program participants, 2,000 fewer children than was budgeted for last year. Since Welfare-to-Work participants rely heavily on license-exempt child care for their child care needs, the increased reimbursement rate to 70% of the current RMR for family child care providers should make finding child care easier, especially for those parents who work fluctuating or non-traditional work schedules

E. Non-CalWORKs Child Care Programs

Non-CalWORKs child care and early education funding includes full and part-day CSPP, the General Child Care Program, Alternative Payment Programs, the Migrant Child Care Program, and the Severely Handicapped Program.

Both General Child Care (center-based and family child care home networks) and Alternative Payment Programs (APP), who administer vouchers allowing families to select their own child care, saw a 6% funding increase to pay for the increases in provider reimbursement rates. General Child Care increased from $305 million to $324 million; APP’s increased from $251 million to $266 million; and the other child care services including migrant and severely disabled programs, increased from $31 million to $32.5 million. While this should have at least prevented disenrollment of currently served families, with enrollment remaining at about 64,000 slots, the Legislative Analyst’s Office projects that there will be a 7% reduction in the APP capacity, due to a failure to account for an increased average cost per case.8

The CSPP received the only slot increases, with an additional $7.8 million in the Budget, to fund just under 3,000 full-day CSPP slots starting on March 1, 2017, to be administered by the LEAs. This will bring total full-year preschool enrollment to 167,000, including both full-day and part-day slots. The decision to fund full-day slots recognizes that working parents need more than part-time care, and it will provide a small increase in preschool capacity. The funding allows more 3 and 4-year olds to be served. However, child care for infants and toddlers represents the most requested, most expensive, and most unavailable form of child care.

Last year, the Legislative Analyst’s Office estimated that 251,000 children were on waiting lists for subsidized child care in California. The estimates this year are close to 300,000 eligible children waiting for a child care subsidy. The Department of Finance currently estimates that 15 percent of children that are currently eligible for state and federally subsidized child care have access to care.9 Sustained advocacy is needed to reach the 85 percent of families who remain on child care waiting lists for subsidized care.

C. Child Care Quality Improvement Funding

The Budget includes $83.8 million for quality improvement.10 It allocates $18.8 million to the resource and referral agencies, $3.35 million for local planning councils, $.225 million for the California Child Care Initiative Project, $1.4 million for a three-year pilot child care workforce training program in Los Angeles County and the approximate $61 million balance to a range of quality improvement initiatives.

New legislative intent language asserts that, to the greatest extent possible, CCDBG quality dollars should support the Quality Rating Improvement System (QRIS), although it also asserts that the state should maintain funding for resource and referral agencies, local planning councils, and licensing enforcement, which will compete with QRIS for quality dollars to implement specific quality improvement initiatives. The Budget requires that by March 1, 2017, CDE develop, for submission as an amendment to its CCDF State Plan, a new quality funding expenditure plan that prioritizes QRIS activities.11

Although over 75 percent of counties now have a QRIS, California lags in its QRIS development, as one of only a few states in the country that has no single, uniformly implemented, state QRIS. It is worth considering that QRIS began as a First 5 California effort funded with federal Race to the Top (RTT) money leveraged with tobacco tax dollars. We should be wary of efforts to utilize increased federal quality improvement dollars to support existing efforts previously funded with other federal and non-federal dollars, which potentially undermines the federal intent to increase quality initiatives through the expanded funding.

Further, QRIS efforts historically focused on center-based preschool programs, although more recent efforts have expanded it to infant and toddler care, and to family child care homes. Technical assistance, financial incentives, and workforce development supports that flow through QRIS are not available to license-exempt care, although local QRIS sometimes make their trainings open to parents and non-participating family, friend and neighbor child care providers. Finally, prioritizing QRIS for all quality funding requires careful consideration to ensure that the system does not penalize child care programs in low-income communities. The United States Commission on Civil Rights has found, for example, that the QRIS system, as applied in Mississippi, heightened funding barriers faced by low-income, African American communities, as they did not have the financial support needed to make improvements necessary to draw down QRIS incentive dollars. We will need to pay careful attention in the development of the required CDE plan to ensure that channeling quality dollars through QRIS does not merely exacerbate funding and quality disparities.

III. Proposals Not Incorporated in the Final Budget

The Legislature provided consistent and focused attention on child care and early education throughout the budget season, and child care benefitted from sustained legislative support. Notwithstanding, the financial commitment in this fiscal year was a modest one, and many worthwhile child care budget items discussed during the budget hearing process were not included in the final budget, despite strong support.

A. CCDBG Requirements

The CCDBG Act of 2014, which reauthorized the Child Care and Development Fund (“CCDF”), pays for all state child care programs except CalWORKs Stage 1 child care. In 2015, child care advocates developed a number of budget recommendations to implement new CCDBG requirements, and presented these recommendations at a legislative briefing held by Sen. Holly Mitchell on December 8, 2015. Some of the recommendations that were considered but not adopted through the budget follow.

1. 12-month Guaranteed Child Care Assistance and Updated Income Eligibility Thresholds

CCDBG requires states to implement a number of policies to promote stable child care assistance. These include that every child in CCDF-funded programs is considered to meet all eligibility requirements and receives program assistance for not less than 12 months before the state redetermines eligibility, regardless of a temporary change in parental employment, job training or educational program activity, or a change in family income, so long as that income does not exceed 85 percent of the current state median income. 42 U.S.C. §9858c(N)(i)(I). This rule appropriately balances the benefit of less burdensome reporting requirements that reduce churn and foster stable child care arrangements with program integrity concerns.

Existing state law requires families to notify their child care contractor within five calendar days of any changes in family income, size, or the need for services. 5 Cal. Code Regs. §§18087(c) and 18102. Child care may be terminated for failure to timely report. CDE acknowledges that it needs to adopt 12-month eligibility so that state law will comply with federal requirements.

Child care protections for working families in the reauthorized CCDBG also include that the state provide a graduated phase-out that allows for tapered assistance to families whose income has increased at the time of re-determination, but still does not exceed the federal income limit of 85% of State Median Income (SMI). Proposed federal regulations would require use of current bureau of census data in the calculation of SMI. The state uses ten year-old State Median Income (“SMI”) data to calculate income eligibility for subsidized child care. Since 2011, income eligibility has been frozen at 70 percent of the SMI in use in FY2007-2008, which is in turn based on 2005 income data. Cal. Educ. Code §8263.1. As a result, California’s income eligibility threshold is at less than 60% of the current SMI. Parents, child care providers, and policymakers have proposed updating the income eligibility threshold for child care assistance, which would allow a greater range of moderate income families to become eligible for subsidized child care and would allow families to maintain their child care until they were at an income at which they could better afford to pay on their own. Families report refusing even slight salary increases because it would put them over the income threshold to maintain their subsidized child care eligibility, and they cannot afford to continue to work and pay for child care without assistance.

Both the Legislative Women’s Caucus and Assembly budget proposals included 12- month eligibility, updating the eligibility threshold to 70% of current SMI and increasing the exit ceiling to 85% of current SMI, but these proposals were not included in the final Budget. A bill to adopt 12-month eligibility and increase income eligibility, sponsored by Parent Voices and the Child Care Law Center, (AB2150) has received near-unanimous support in both houses, and is officially supported by CDE. It continues to work its way through the legislative process and would help California’s working families struggling to pay for child care.

3. Health and Safety Training and Site Monitoring

California remains severely out of compliance with CCDBG requirements regarding health and safety training and monitoring, and its request for waiver of these requirements has been denied by the federal agency charged with compliance. Specifically, we do not ensure annual inspections, an issue briefly considered in early budget discussions, and we lack health and safety training and professional development opportunities for license-exempt providers. Of concern, the Budget includes language urging that all federal CCDBG quality dollars be used to support QRIS activities. The CCDBG Act of 2014 requires that states use a higher percentage of funds for quality activities, but specifies the range of quality activities to be included. QRIS is only 1 of 10 specified quality activities, which also include supporting training and professional development of the child care workforce to meet new professional training requirements. Further, license-exempt child care providers are not eligible to participate in QRIS. CDSS Community Care Licensing’s Child Care Licensing Program currently provides some, but not all, of the health and safety training that CCDBG requires, to some, but not all CCDBG-funded child care providers. Most critically, training for license-exempt family friend and neighbor care is not included. Thus, layering the high quality aspirations of the QRIS system on the health and safety training floor of our current licensing system results in some holes that reach from the ceiling to floor.

4. Resource and Referral Network Statewide Database

The Assembly budget included $15 million for a Data Efficiency Management Project which would have funded a more robust consumer education website. It would also have been the cornerstone of a plan to provide an on-line portal to apply and have eligibility determinations for subsidized child care.

B. Additional Voucher Slots, especially for 0-3 year olds

As mentioned above, the only additional child care capacity was directed to CSPP full- day/full year slots. The Budget did not specifically address the close to 300,000 eligible children on waiting lists for subsidized care. The Legislative Women’s Caucus had recommended an additional 25,000 child care slots; the Assembly Early Education package had provided for 6,000 AP slots and 10,000 CSPP slots, split between part-day and full-day slots.

IV. Conclusion

The reinvestment in child care and early education of $145 million this year, annualized to $276 million in subsequent years, will help working parents obtain safe, quality child care while offering much needed increases in payment rates for child care providers. The budget allocation in child care and early education fell short of the amount the Women’s Legislative Caucus sought and is much less than the amount needed to significantly reduce the number of eligible children languishing on waiting lists. However, the dedication of policymakers to a multi-year commitment to early education and child care and the continued reinvestment holds out hope for further progress. The Child Care Law Center strongly urges further financial support for child care and early education to increase access to child care and improve child care quality.

1 This total is comprised of state general funding, federal Temporary Assistance to Needy Families (TANF) and Child Care Development Funding (CCDF). Child Care Law Center analyzes the child care budget separately from the $1.8 billion for preschool, as well as the $726 million in Proposition 98 funds for Transitional Kindergarten, which the California Department of Education did not include in prior annual early care and education budgets.

2 All RMR budget amounts include child care accounts funded through the Department of Education (CDE), and, for CalWORKs Stage 1 child care, the Department of Social Services (DSS). For example, the cost to update the RMR to 75th percentile of 2014 RMR survey is $28.85M (CDE) and $9.95M (DSS) for a total of $38.8M.

3 Cal. Legislative Women’s Caucus letter of May 13, 2016. http://womenscaucus.legislature.ca.gov/news/ 2016-05-13-womens-caucus-leaders-may-revise-child-care-keeps-ca-working-economy-strong.

4 The State plan shall certify that payment rates for the provision of child care services… are sufficient to ensure equal access for eligible children to child care services that are comparable to child care services in the State or sub-state area involved that are provided to children whose parents are not eligible to receive assistance under this subchapter … and shall provide a summary of the facts relied on by the State to determine that such rates are sufficient to ensure such access.

5 Senate Bill 828, Sec. 4, amending Cal. Ed. Code § 8357(a) and (b).

6 The new annual reimbursement rate for full-day, center-based State Preschool will be $10,596 per child. The new annual rate for full-day, center-based General Child Care for a preschool-aged child will be $10,530. 7 SB828, Sec. 3, amending Cal. Education Code, Section 8265(b).

8 The Legislative Analyst’s Office projects a 7% reduction in the number of children who will be served with a child care subsidy in the APP (from 32,852 in FY 2015-16 to 30,614 in FY 2016-17). This reduction would be based on the Legislature not providing a sufficient adjustment in the average cost of care, above and beyond the rate increase. http://www.lao.ca.gov/reports/2016/3491/EdBudget-072016.pdf. 9 Department of Finance Bill Analysis of AB2150. http://www.dof.ca.gov/legislative_analyses/LIS_PDF/15/AB-2150-20160718035137PM-AB02150.pdf.

10 This total is comprised of $60 million in federal CCDF and $23.8 million in state funding. Quality Improvement dollars have gone from a high of $109 million in 2009-10 to our current $83.8 million. The state must use at least 7% of state funds to match its federal quality dollars, with an additional 3% directed to infants and toddlers. The amount that the state needs to spend to meet its match requirements will continue to go up as the federal quality dollars increase in future years, and them level out.

11 CDE must submit its plan to the Legislature in February, 2017. Senate Bill 826, Budget Act of 2016.