The California Legislature passed, and the Governor signed on June 27, 2019, the Budget Act of 2019, Assembly Bill 74 (AB 74) (the “Budget”).[i] On June 27, 2019, Governor Newsom also signed the Human Services Omnibus Bill, Senate Bill 80 (SB 80), containing sweeping changes to the CalWORKs Stage 1 Child Care program,[ii] and SB 75, the Education Omnibus Budget Trailer bill.[iii]

The following analysis addresses key child care and early education items in the Budget in light of recent funding history, as well as the changes in state and federal funding for child care in this year’s budget cycle. Total funding for all California child care and development programs for fiscal year 2019-2020, including one-time funding, state preschool and afterschool program funding, increased from 4.6 billion in the 2018-19 budget to a total of $5.3 billion.[iv] This $673 million represents a 14% increase over the 2018-19 child care budget, much of it in one-time money.

There will be a modest increase in the number of children receiving affordable early childhood education as a result of the 2019-20 budget. Enrollment is expected to increase by 4% from last year, from 897,530 to 935,524 children.[v] This increase is divided amongst preschool spaces, the three stages of CalWORKs child care, Alternate Payment vouchers and spaces in child care centers.

This year’s ECE budget represents a new era of initiative and recommendations originating in the Governor’s office, in partnership with the ongoing strong Legislative leadership and commitment to expanding opportunities for all of California’s children. Many of the legislative priorities for this year’s ECE budget were informed by the recommendations in the Assembly Blue Ribbon Commission’s Report on Early Childhood Education, which provides a detailed blueprint for how to move toward a vision for our ECE system.[vi]

I. Overview of Child Care and Preschool Funding Increases in 2019-20 Budget

Funding for all child care programs increased $673 million over the budget for 2018-2019, bringing the total of ongoing and one-time funding to $5.3 billion. The Budget is funded with combined Proposition 98 and non-Proposition 98 General Funds (GF) of $3.8 billion; $80.5 million in special Proposition 64 funds and $1.4 billion in federal funds and reimbursements. A large share of the Budget increase – $460 million – represents one-time General Funds to build overall capacity, including facilities grants, infrastructure investments, and workforce development. The highlights are:

- $ 143.3 million additional funds to provide 12,545 new affordable child care spaces, divided between:

- $80.5 million from Proposition 64 (Cannabis) funds and $12.8 million Child Care Development Block Grant (CCDBG) funds to fund 9,459 Alternative Payment (AP) spaces

- $50 million in one-time GF, with the plan to fund future years with Proposition 64 funds for 3,086 spaces in child care centers.

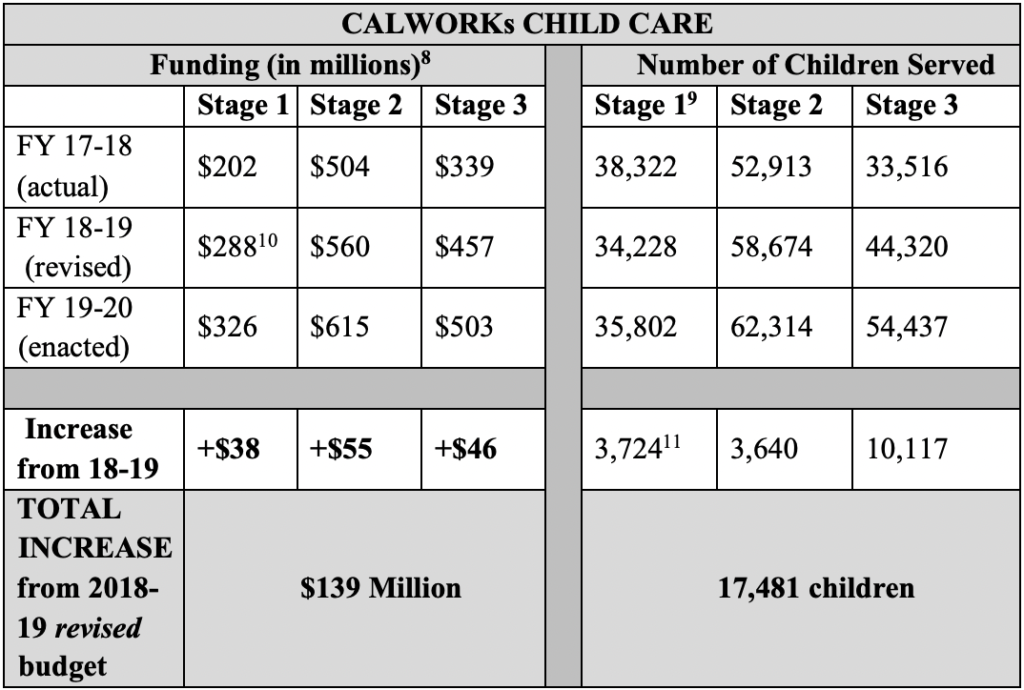

- $159 million additional funds for all three stages of CalWORKs child care

- $104 million additional funding (GF and Child Development Block Grant, “CCDBG”) for CalWORKs Stage 2 and Stage 3 child care so that 13,757 more children can keep their affordable, continuous child care, and for increases in average cost of care.

- $56.4 million Temporary Assistance to Needy Families (TANF) and GF in 2019-20 and $70.5 million ongoing to give an additional 3,724 children in the CalWORKs program immediate, full-time, and continuous Stage 1 child care.

- $50 million in GF for rate increases in the After School Education and Safety Program (ACES).

- $125 million in GF for 10,000 new full-day California State Preschool Program (CSPP) spaces for non-Local Educational Agency (LEA) programs, starting July 1, 2019. (31.4 million in GF to implement as of April 1, 2019)

- $10 million GF to increase access to the Emergency Child Care Bridge Program for foster children who need child care while in out-of-home placements. This increase has a possible sunset date of December 31, 2021.

- $10 million one-time GF to pay for the data collection and database to support identifying family child care providers who will be eligible for collective bargaining.

- $10 million to fund a statewide “cradle to career” longitudinal data system

- $36.4 million to fund a 3.26% COLA for capped programs (everything except CalWORKs child care)

- $263 million onetime GF for the Early Learning and Care Infrastructure Development Grants Program, which includes an$18 million transfer from the Child Care Facilities Revolving Loan Fund, for grants to family child care providers, centers and preschool providers for facilities expansions and upgrades, to be spent over four years

- $195 million one-time GF for the Early Learning and Care Workforce Development Grants Program, to be spent over four years.

II. Analysis of the Enacted 2019-20 Budget

The Budget made significant one-time investments in facilities, materials and teacher education to build capacity to benefit children, while making only a modest down payment on making affordable child care available to every eligible child.

- Immediate and Continuous Eligibility in Stage 1 Child Care

This year’s Budget and policy changes contained in SB80[i] make significant changes in how families participating in CalWORKs will get good, consistent child care services in the Stage 1 Child Care program. The Budget provides $56.4 million in a combination of Temporary Assistance to Needy Families (TANF) and GF in 2019-20 and $70.5 million ongoing, to give an estimated additional 3,724 children in the CalWORKs program immediate, full-time, continuous child care. The expansion in the Stage 1 child care program will promote stability, foster children’s healthy development, and open opportunities for children, families and communities.

Beginning October 1, 2019, counties must authorize Stage 1 Child Care immediately upon approval of the CalWORKs application, and continuously for 12 months or until families are transferred to Stage 2. In addition:

- Families will be authorized for full-time care, unless the parent decides that part-time care better meets their needs;

- Families can get child care to participate in activities such as family support and stabilization, domestic violence or mental health counseling, housing search, as well as work, education and training;

- Counties must verify that child care has been secured before the parent can be required to participate in any mandated activity, including initial appointments;

- Parents who have been sanctioned from the CalWORKs program must get child care once they indicate an intent to participate in any of a broad range of program activities.

- At the time of transfer, families may not be discontinued from Stage 1 until confirmation is received from the Stage 2 contractor that the family has been enrolled, or that the family is not eligible for Stage 2 child care.

The Department of Social Services will soon be issuing guidance to counties and Stage 1 contractors, in the form of an All County Letter until regulations can be issued, on how to implement these new policies. In addition, forms and notices will be revised to reflect the new policy, and county workers and contractors will receive training on the new policy and procedures.

B. 17,000 Additional Children will Benefit from Stable, Affordable Care in all Three Stages of CalWORKs Child Care

Parents have a right to receive CalWORKs child care as a supportive service while they participate in CalWORKs welfare-to-work and other program activities, and after they no longer receive CalWORKs cash assistance, so long as they remain eligible for the state-subsidized child care program. The Legislature determines the budget allocation for CalWORKs child care based on anticipated caseload. In 2017, the Legislature raised the long-frozen income ceilings and adopted 12 month continuous eligibility. Now, families are not churning off Stages 2 and 3 child care, creating needed stability for children, families and child care providers, and giving children the continuous care they need to thrive.

The Budget allocates an additional $104 million to pay for a projected 13,757 more children in Stages 2 and 3 child care, as well as funding for higher reimbursement rates for care. Below is breakdown of recent CalWORKs child care funding and enrollment in all three CalWORKs stages:

[i] Human Services Omnibus, S., S. B. 80, 2019-20 Sess., ch. 27 (Cal. 2019) (enacted). See id. §1 (amending Cal. Educ. Code § 8350(c)); id. §§ 46-51 (amending Welf. & Inst. Code §§ 11323.2-.4).

C. Modest Increase in AP Vouchers; Time-Limited Vouchers Converted to Ongoing

Alternative Placement (AP) vouchers provide good, affordable child care that gives parents the flexibility to find nurturing, culturally competent, linguistically appropriate care for their children, as well as care that meets their scheduling needs for working in the 24/7 economy. Using $80.5 million in this year’s Proposition 64 (Cannabis) distribution, and $12.8 million in CCDBG funding, the Budget funds an additional 9,459 AP vouchers. In addition, the 11,307 time-limited vouchers created in last year’s budget have been converted to ongoing vouchers. This is a recognition by the Administration that the increased federal CCDBG funding is not one-time money; instead, it is an ongoing increase that we can expect to continue.

D. Early Learning and Care Infrastructure and Workforce Development Grants Program

i. Early Learning and Care Infrastructure Grant Program

The budget allocates $245 million, with an additional $18 million transferred from the Child Care Facilities Revolving Loan Fund, for grants to non-school based licensed early learning and care facilities, including child care centers, preschools, and family child care homes. The grants can be used for:

1) Construction of new early learning and care facilities to increase capacity or recover lost capacity as a result of a state or federally declared disaster.

2) Renovation, repair, modernization, or retrofitting of existing facilities to increase capacity, recover lost capacity due to a disaster, or make facilities more resilient to future natural disasters.

3) Renovation, repair, modernization, or retrofitting of existing facilities, or to comply with health and safety or other licensure requirements. The Superintendent will establish criteria to select high-need providers who can show financial hardship.[i]

The grants will be competitively awarded over the next four years and will be limited to child care centers in the first year. Grants will be prioritized for providers who serve children in high need communities with lack of affordable child care; are located in areas impacted by natural disasters; or care for children 0-5 with exceptional needs. Applicants must demonstrate they will provide increased access, and sustain that access, to subsidized child care.

CDE will issue guidance to the field on the criteria for grant awards. While the grant money must to be used for “one-time infrastructure costs” mainly related to new construction, renovations, and repairs, CDE can decide to use the grants for “other related costs.”[ii] Prioritizing funds for family child care providers in the infrastructure grant awards will help fulfill the purpose of these funds as family child care is the primary source of infant and toddler care and California has seen almost a one third drop in family child care capacity in the last decade.

ii. Early Learning and Care Workforce Development Grant Program

The Budget includes $195 million one-time GF for grants for child care and preschool workforce professional development and education to improve the quality of care and provide avenues for child care professionals to move along the early education/child care professional continuum. This one-time funding will be allocated over the next four years. It will be important to ensure that these funds and opportunities are made available to all providers of ECE. Principles of equity should inform this project so that language, geography and cost do not create access barriers. Further, professional development criteria should recognize classroom experience, focus less on degree attainment, and use culturally appropriate models for mentoring and coaching.

C. Laying the Groundwork and Stated Intention to Move Toward Universal Preschool

Total preschool funding has increased by $89.1 million from the prior budget year, to a total of $1.48 billion. The Budget allocates $31.4 million in 2019-20 and $124.9 million in 2020-21 to fund an additional 10,000 full-time preschool spaces through non-LEA providers, effective April 1, 2020. The expanded capacity in the State Preschool Program will be targeted to children who live in a school attendance area where 80 percent or more students qualify for free or reduced price meals. The Budget also converts $297 million of Proposition 98-funded non-LEA part day state preschool to non-Proposition 98 GF.

The Governor has announced that this “Budget includes targeted, ongoing investments that put California on the path to universal preschool.”[iii] Using the approach of targeted universalism, this year’s trailer bill expands preschool eligibility for children from economically distressed communities.[iv] It eliminates the work requirement for eligible families to access the full-day State Preschool Program.[v] Yet, working families are also prioritized for full-time California State Preschool. It is unclear from the implementing budget language how the priority of serving working families will be balanced against the automatic eligibility for the lowest income families who live in targeted low-income communities.

The Governor proposes that additional funding and priorities for subsequent years’ funding will be determined based on the recommendations contained in the Master Plan for Early Learning and Care that was funded at $5 million in the Budget, and is to be released by October 1, 2020. The Master Plan will be administered by the Secretary of the Health and Human Services Agency, and acknowledges the need to build on recent work by the Legislature, particularly the Assembly Blue Ribbon Commission on Early Childhood Education, and the California Department of Education. It will include strategies to address facility capacity, a trained workforce, universal access to preschool, and revenue options to support the Plan.

i. Ongoing Health and Safety Concerns for Preschools Exempted from Title 22 Licensing Requirements

While not mentioned in this year’s budget, language contained in last year’s budget trailer bill stipulated that LEA-administered preschools that are serving children ages 4 and older would be exempt from Title 22 child care health and safety licensing regulations and would be able to operate without first having a licensing inspection. The California Department of Education (CDE) has issued emergency regulations to govern these LEA-administered preschools that qualify for the exemption which became effective on July 1, 2019.[vi]

Concerns remain about the loss of licensing protections related to consumer protections and transparency. Parents will no longer have the ability to view inspection reports or records of violations that have been issued against a particular preschool on a public school site. Additionally, the uniform complaint process that is available to report problems lacks the timeliness, transparency and accountability that is available to parents whose children attend a child care center that must comply with Title 22 licensing regulations.

D. Funding to Support Children with Exceptional Needs/Disabilities and Inclusive Facilities

The Budget took several important steps to serve more children with exceptional needs or severe disabilities. The 2018-19 budget had increased the adjustment factors that incentivize caring for special populations, including infants and toddlers, and children with exceptional needs. This year’s Budget extended the adjustment factors to part-day California State Preschool programs. Last year’s budget had also designated $167 million for the Inclusive Early Education Expansion Program, and an additional $10 million was added this year. There have been delays in the RFP and grant award process and it is now expected that grant proposals will be awarded for December 12, 2019 to June 30, 2023.[vii]

The categories of enhanced adjustment factors adopted by the Legislature are meant “to reflect the additional expense of serving children who meet any of the criteria outlined…” For children with exceptional needs or severe disabilities, it “shall be used for special and appropriate services for each child for whom an adjustment factor is claimed.”[viii]

Unfortunately, the documentation requirements to qualify for reimbursement for these adjustment factors meant to encourage providers to serve children with special needs are overly burdensome. Providers must submit not only the child’s Individualized Education Plan (IEP) or Individualized Family Service Plan (IFSP), but also medical documentation of the special services needed and proof of ongoing fiscal impact. These restrictive rules to qualify for the 1.54 adjustment factor for a child with exceptional needs means that a very small proportion of the providers who care for children who qualify are receiving this payment differential.[ix] Parents whose children have exceptional needs have a particularly difficult time trying to find a child care provider who is willing to care for their child, and providing the adjustment factor as the Legislature intended is one tool to improve access to early learning and care for children with disabilities.

One promising sign is that the Budget includes $493.2 million to provide grants to LEA’s operating preschools serving 3 and 4 year olds with Individualized Education Plans (IEP’s). The purpose of this funding is to make sure that children with IEP’s are getting the early intervention and inclusive child care so that services are not delayed until they arrive in Kindergarten. School districts already are required to identify children who are experiencing developmental delays or are at risk of developmental delays under Part B of the Individuals with Disabilities Education Act (IDEA).[x] Hopefully, this new funding will give school districts the capacity to fulfill their “child find” duties and provide the assessments, plans and early intervention services when they are most effective.

E. CDE infrastructure and Staffing

The Budget provides $1.8 million in ongoing GF to fund thirteen positions to address the increased workload associated with the expansion of early education programs.

F. Child Care Items Not Addressed in the Year’s Budget

The Budget also did not implement any portion of the new reimbursement rates that are called for under the 2018 Regional Market Rate (RMR) survey, or adopt any of the policies recommended by the Rate Reform Workgroup. This will put us further behind in ensuring the required access to the 75th percentile of the private market rates for subsidized care, and will make it more difficult to align the currently bifurcated rate structures that operate in California between and RMR and the Standard Reimbursement Rate (SRR).

G. Related Budget Items Aimed at Improving the Lives of Children

Expanded Earned Income Tax Credit (EITC) – The Budget more than doubles the EITC (EITC), adding $1 billion in a new expanded EITC. The expansion includes help for low-income families with young children (ages 5 and under) by providing an additional $1,000 annually to address the costs of raising young children. The expanded EITC and young child credit are expected to reach a total of three million low-income families and do not require demonstration of specific child-related costs.

Increase CalWORKs grants to 50% of the Federal Poverty Level – 450,000 California children live in deep poverty. This CalWORKs grant increase will bring most families’ CalWORKs grants to at least 50% of the FPL, or $10,665 annually for a household of 3.

Increase Paid Family Leave to 8 weeks with 90% Wage Replacement – Allows employees to take leave for up to 8 weeks to bond with a new child (biological, adopted, foster). The increased wage replacement (from 60% to 90%) means that more workers will be able to afford to take this time.

Expanded Voluntary Home Visiting Program – The Budget appropriated $46 million in state funds to augment the federal funding for the California Home Visiting Program, providing services to first-time mothers during pregnancy and after birth. In addition, the CalWORKs Home Visiting Program was made permanent in the Budget ($90 million in combined TANF and GF), providing up to 24 months of home visiting for CalWORKs parents who are pregnant or parenting children under the age of 2.

III. Conclusion

This year’s budget demonstrates a deep, value-based commitment to supporting families and children with bold new expenditures in child care and early education and overall family support. We know that equal opportunity begins with equal access to safe and healthy child care, so that parents can support their families and children can thrive.

Endnotes

[i] Budget Act of 2019, Assemb. B. 74, 2019-20 Sess., ch. 23 (Cal. 2019) (enacted).

[ii] Human Services Omnibus, S., S. B. 80, 2019-20 Sess., ch. 27 (Cal. 2019) (enacted).

[iii] Education Finance: Education Omnibus Budget Trailer, S., S. B. 75, 2019-20 Sess., ch. 51 (Cal. 2019) (enacted).

[iv] Dept. of Finance: California Child Care Programs. Local Assistance – All Funds. 2019-20 Budget Act. The Budget Act established total California early care and education program and operations funding for 2019-20 at $5,334,954,000 a 14% increase from last year’s total funding of $4,662,128,000. All figures are rounded to the nearest tenth and may not precisely equal the total amount.

[v] Dept. of Finance: California Child Care Programs. Local Assistance – All Funds. 2019-20 Budget Act. Full year enrollment is an estimate based upon the total number of children who can be served for a full year in that particular program, based on that year’s appropriation. It does not reflect the actual number of children served in a particular program.

[vi] Cal. Assemb. Blue Ribbon Comm’n on Early Childhood Educ., Final Rep., Assemb., 2019-20 Sess. (2019), https://speaker.asmdc.org/sites/speaker.asmdc.org/files/pdf/BRC-Final-Report.pdf.

[viii] Education Finance: Education Finance Omnibus Budget Trailer, S., S. B. 75, 2019-20 Sess., ch. 51 (Cal. 2019) (enacted) (codified at Cal. Educ. Code § 8280, added to Chapter 2 of Part 6 of Division 1 of Title 1 of the California Education Code). The Budget allows for up to 5 percent of the grant funding to be used for addressing health and safety or licensing requirements of existing facilities. Cal. Educ. Code § 8280 (l)(3)(C).

[ix] Cal. Educ. Code § 8280(f).

[x] Cal. Dep’t of Fin., 2019-20 Enacted Budget Summary, Early Childhood, at 26 (2019), http://www.ebudget.ca.gov/2019-20/pdf/Enacted/BudgetSummary/EarlyChildhood.pdf.

[xii] Education Finance: Education Finance Omnibus Budget, S., S. B. 75, 2019-20 Sess., Ch. 51, (Cal. 2019) (enacted).

[v] Id., amending Cal. Educ. Code § 8263(a)(2) (“A family shall be eligible for a California state preschool program without meeting the requirements of subparagraph (B) of paragraph (1).”).

[vi] The California State Preschool Program (CSPP) Local Educational Agencies (LEA) Exempt Emergency Regulations have been posted to the CDE Proposed Rulemaking and Regulations web page, available at: https://www.cde.ca.gov/re/lr/rr/leaexempt.asp.

[vii] Cal. Dept. of Education, Early Learning and Care Division (ELCD), FY 2018-19 Inclusive Early Education Expansion Grants Request for Applications, available at: https://www.cde.ca.gov/fg/fo/r2/ieeep1819err2.asp.

[viii] Education Finance: Education Omnibus Trailer Bill, Assemb. B. 1808, 2017-18 Sess., ch. 32, § 11 (Cal. 2018) (enacted) (amending Cal. Educ. Code § 8265.5). Children are considered to have “exceptional needs” if they are either an infant or toddler with a developmental delay or established risk condition, or are at high risk of having a substantial developmental disability — or a child age 3-21 who has been determined to be eligible for special education and related services by an individualized education program team. This includes “severely disabled children.” Cal. Educ. Code § 8208(l) and (x).

[ix] Cal. Dept. of Education, Early Education and Support Division (EESD), “Exceptional Needs Average Child Count Fiscal Year 2016-17”; “Severely Disabled Average Child Count Fiscal Year 2016-17.” The California Dept. of Education reported that in 2016-17, only 3,214 children with exceptional needs were granted the adjustment factor statewide and 118 children with severe disabilities were granted it. Moreover, CDE does not track if the adjustment factor is ever granted to licensed family child care providers caring for children with disabilities.

[x] Individual Students with Disabilities Education Act, Part B, 20 U.S.C. § 1411 – 27 (Subchapter II); Cal. Educ. Code § 56441.3(a).